The first quarter of 2025 has presented a complex landscape for the home improvement industry. Major retailers like Home Depot, Lowe’s, and Ace Hardware have reported mixed results, reflecting broader economic challenges such as tariff uncertainties, inflation, and shifting consumer behaviors.

For home installation contractors and remodeling professionals, understanding these trends is crucial for navigating the months ahead.

As the leading installation management software for contractors, including Lowe’s and Home Depot installers, Cilio is here to highlight the opportunities that still exist in today’s home improvement market.

Home Depot: Steady Sales Amid Strategic Diversification

Home Depot reported a 9.4% increase in revenue, totaling $39.86 billion for Q1 2025. However, net earnings dipped by 4.6% to $3.4 billion. Comparable U.S. store sales saw a modest rise of 0.2% .

Key takeaways include:

- Supply Chain Resilience: Over 50% of Home Depot’s inventory is sourced domestically, reducing vulnerability to international tariffs. The company aims to ensure that no single foreign country accounts for more than 10% of its purchases within the next year.

- Strength In Non-Discretionary Purchases: Home Depot noted a 6.5% drop in big-ticket transactions over $1,000. However, non-discretionary projects and products like water heaters, air conditioning, and roofing materials continue to show promise.

- Pricing Strategy: Despite tariff pressures, Home Depot does not plan broad-based price increases, aiming to maintain competitive pricing and customer loyalty.

- Pro Market Focus: Sales in pro-heavy categories like gypsum, decking, and concrete outpaced DIY segments, indicating robust demand in professional markets.

Lowe’s: Navigating Challenges with a Pro-Centric Approach

Lowe’s experienced a 2% decline in total sales, bringing in $20.9 billion for the quarter. Net earnings fell by 6.5% to $1.64 billion, with comparable store sales down 1.7%.

Notable points:

- Pro Sales Growth: Mid-single-digit growth in professional sales highlights Lowe’s strategic emphasis on serving contractors and builders.

- Softening Sales: Lowe’s saw a 7.6% decline in purchases over $500.

- Supply Chain Strategy: Approximately 60% of Lowe’s purchases are U.S.-sourced, with 20% from China, allowing for competitive pricing despite global trade challenges.

- Customer Service Recognition: Lowe’s was acknowledged by J.D. Power for excellence in home improvement customer service, reflecting its commitment to customer satisfaction.

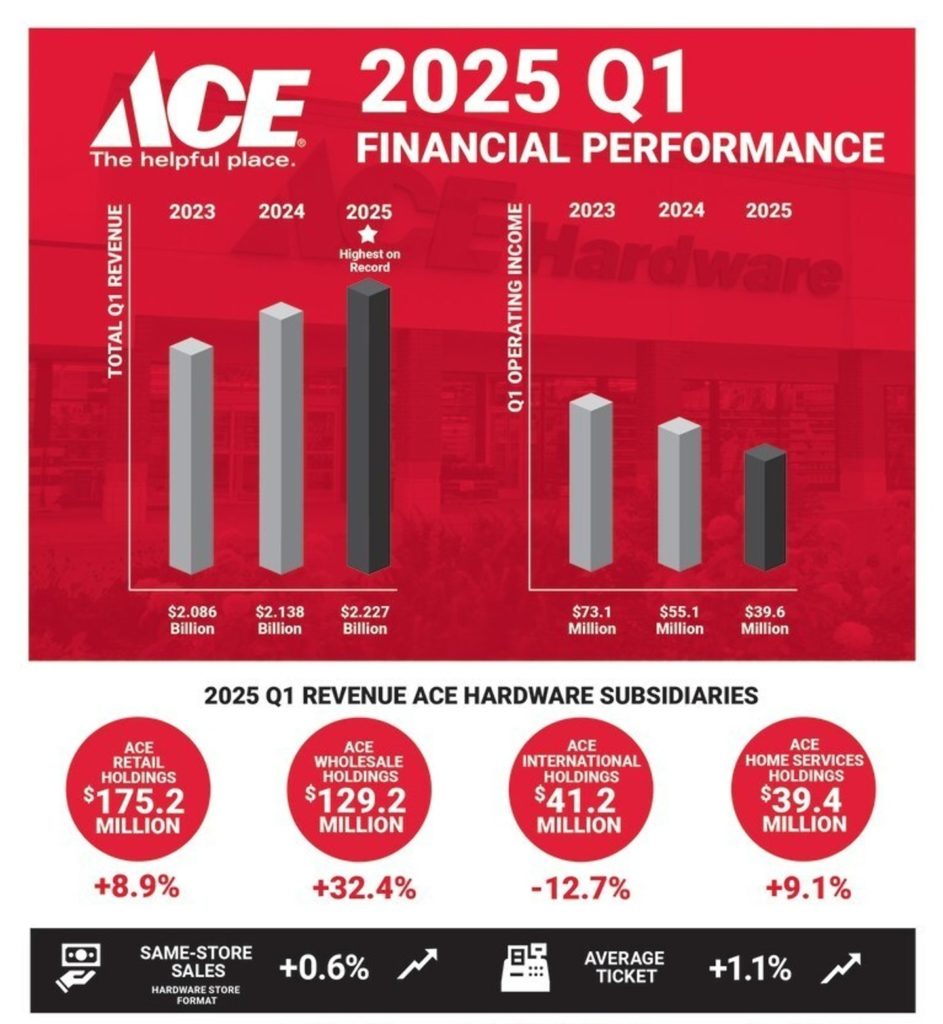

Ace Hardware: Record Revenues with Cautionary Notes

Ace Hardware reported record-breaking Q1 revenues of $2.2 billion, a 4.2% increase from the previous year. However, net income decreased by $16.6 million, attributed to increased marketing expenses and supply chain investments

Highlights include:

- Digital Expansion: A 35% increase in digital business underscores Ace’s commitment to enhancing its online presence to service remodeling and contractors.

- Store Growth: The addition of 45 new domestic stores reflects ongoing expansion efforts.

- Tariff Impact: Ace anticipates passing increased costs from new tariffs onto customers, who in turn would pass these costs onto consumers – further influencing purchasing decisions.

Contractor Sentiment: A Cautious Outlook

The Farnsworth Group’s Q2 Contractor Index reveals a decline in contractor optimism:

- A consecutive quarterly drop in confidence regarding business prospects over the next six months.

- A 16% year-over-year decrease in contractors expecting revenue growth.

- While backlogs remain steady, lead volumes and close rates are softening, indicating potential challenges ahead.

These insights suggest that contractors are completing projects that were sold before the recent dip in consumer confidence and may face a more competitive environment moving forward.

Key Takeaways for Contractors

Given the current landscape, contractors should consider the following moving forward:

Strength In Pro Contractor Segments

Despite overall sales softness, the retailers highlighted resilience in their professional contractor (Pro) segments. Home Depot’s acquisition of SRS Distribution aims to bolster its Pro offerings, while Lowe’s reported strong performance in Pro categories like roofing and drywall.

Consumer Caution and Deferred Spending

High mortgage rates and inflation have led consumers to delay larger scale discretionary home improvement projects. Home Depot’s CFO mentioned that customers are financially sound but are waiting for more favorable economic conditions before undertaking significant renovations.

Workforce Shortage

The construction industry needs to attract approximately 439,000 additional workers in 2025 to meet demand, according to the Associated Builders and Contractors (ABC). This may create an urgency to complete projects while also investing in workforce development and leveraging technology to maximize current workforce numbers.

Stable Outlooks Amid Challenges

Given that Lowe’s and Home Depot reaffirmed guidance combined with the bullets above, despite overall economic uncertainty, the fundamentals of the residential single family housing market are very strong which bodes well for those contractors that are efficient, innovative and focused on taking market share.

As 2025 progresses, staying agile and informed will be key for contractors navigating the evolving home improvement landscape.

How Cilio Helps Contractors Lead Through Uncertainty

As Q1 earnings and contractor sentiment make clear, 2025 isn’t a year for business as usual. With consumer confidence dipping and growth projections flattening, contractors who win this year will be more agile, more efficient, and more strategic than their competitors.

Rick Olejnik, CEO & President of Cilio Technologies, puts it this way:

“Despite the current economic uncertainty, Lowe’s and Home Depot’s reaffirmed guidance underscores the strength of the residential single-family housing market. This foundation is solid for contractors who stay efficient, innovate, and focus on capturing market share. The opportunities are there, and success will go to those who adapt and execute.”

Cilio’s installation management platform is built for exactly this kind of moment. It gives installation companies and contractors the infrastructure to:

- Manage every job with precision, from lead capture to final closeout.

- Unify communication across teams, partners, and customers, eliminating costly missteps and delays.

- Stay on schedule and on budget, even as supply chain and consumer dynamics shift.

- Access real-time data that reveals inefficiencies, bottlenecks, and opportunities for growth.

In a market where margins are tight and time is short, Cilio helps you pull ahead while others fall behind.

Want to learn how you can get ahead?

Schedule a demo with Cilio and learn how you can work smarter, not harder to modernize your home installation operations and harness growth as it happens.